Case Study

Banking in SnelStart Bookkeeping

SnelStart, trusted by thousands of accountants and businesses, now offers SnelStart Bankieren—a fully integrated banking solution powered by Flow.

Seamless Banking Integrated into Accounting

SnelStart has been helping small businesses and accountants manage their finances for decades. With over 5,100 accountants and hundreds of thousands of business users, they know the daily struggles of financial admin. Flow partnered with Adyen to help SnelStart launch SnelStart Bankieren—a fully integrated banking experience that eliminates friction, automates financial workflows, and puts businesses in control of their cash flow. No more switching between apps. No more manual transaction matching. Just a business bank account built right into accounting, where it belongs.

The Problem

Disconnected Financial Services

Businesses rely on multiple financial tools—a bank for transactions, accounting software for bookkeeping, payment links for invoices, a POS system for sales, and sometimes a lending product. While essential, these services don’t work together, creating unnecessary complexity.

Setting up and maintaining them is a hassle—each service requires separate onboarding, verification, and manual integrations.

They don’t share data or intelligence, meaning businesses waste time linking systems, reconciling transactions, and doing double work.

Costs are higher—banks and service providers charge extra simply to connect, treating small businesses as individual clients rather than integrated financial operations.

Instead of streamlining operations, financial tools create more admin, more costs, and more inefficiencies.

The Solution

Everything in One Place

With SnelStart Bankieren, banking and accounting finally work together. Instead of juggling separate tools, businesses get a fully integrated financial system where transactions, payments, and bookkeeping are seamlessly connected. This eliminates manual admin, reduces costs, and makes managing money effortless.

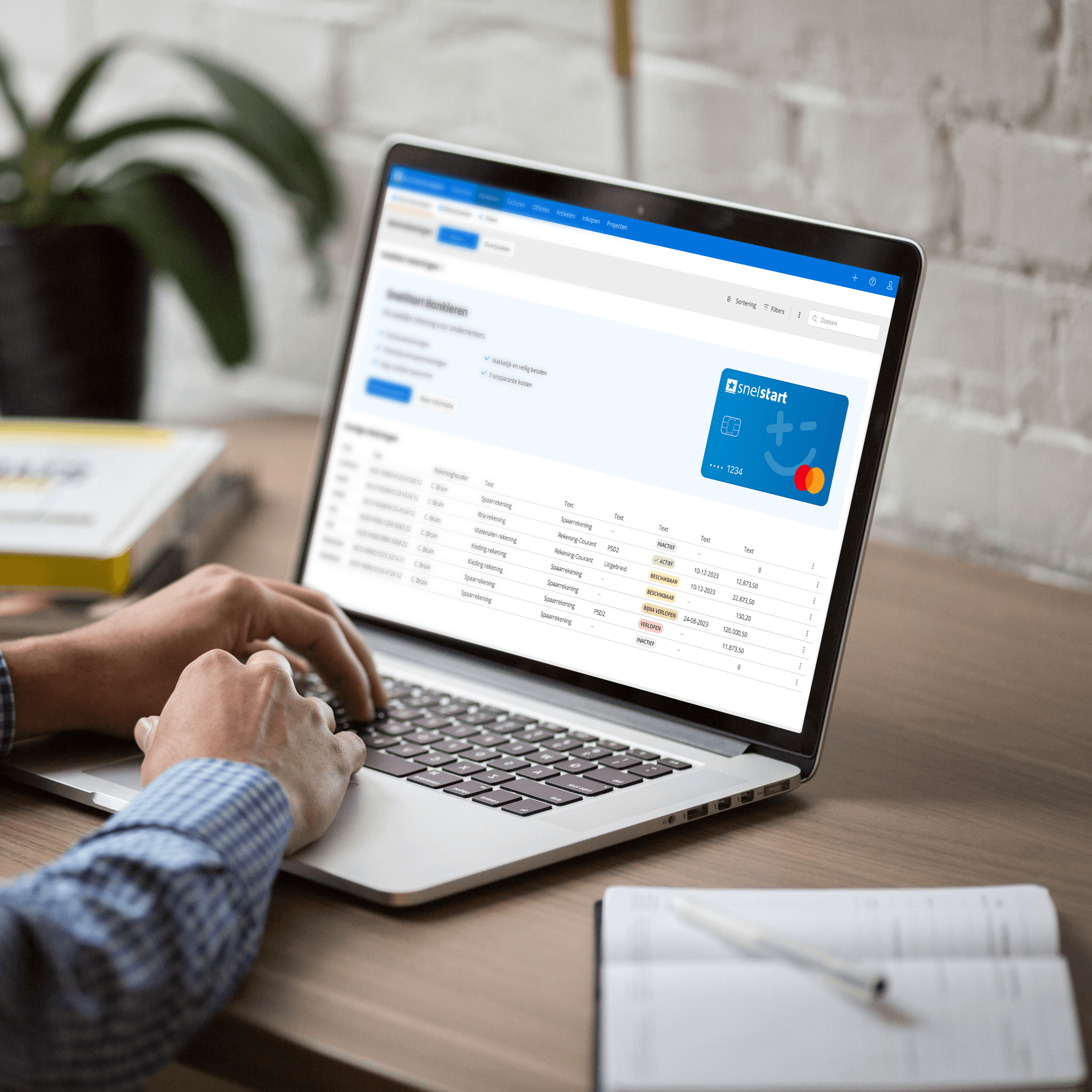

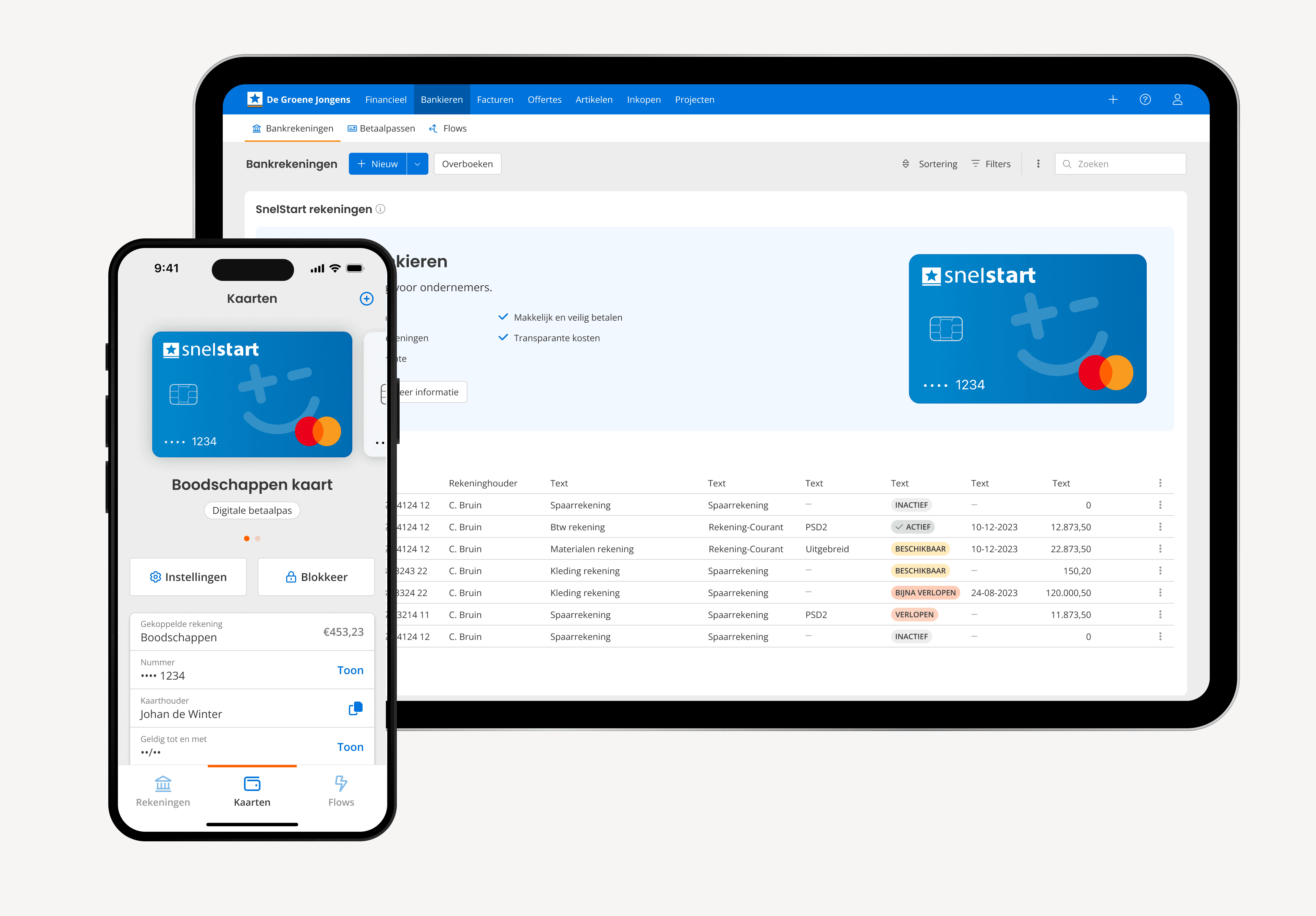

Banking Integrated Directly into Accounting

A bank account that lives inside your accounting software means no more manual imports or transaction matching. Payments, expenses, and cash flow updates happen in real-time, directly in SnelStart.

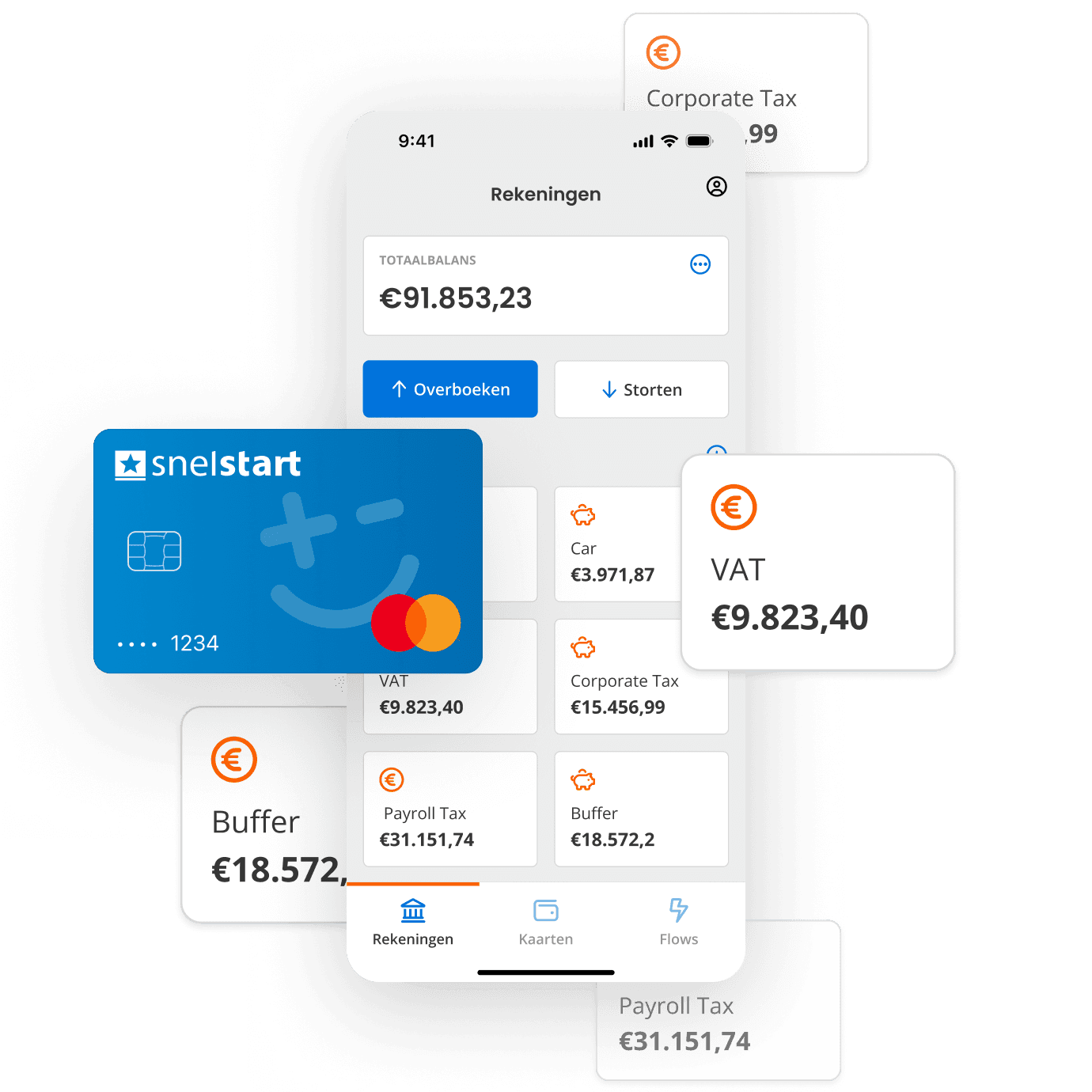

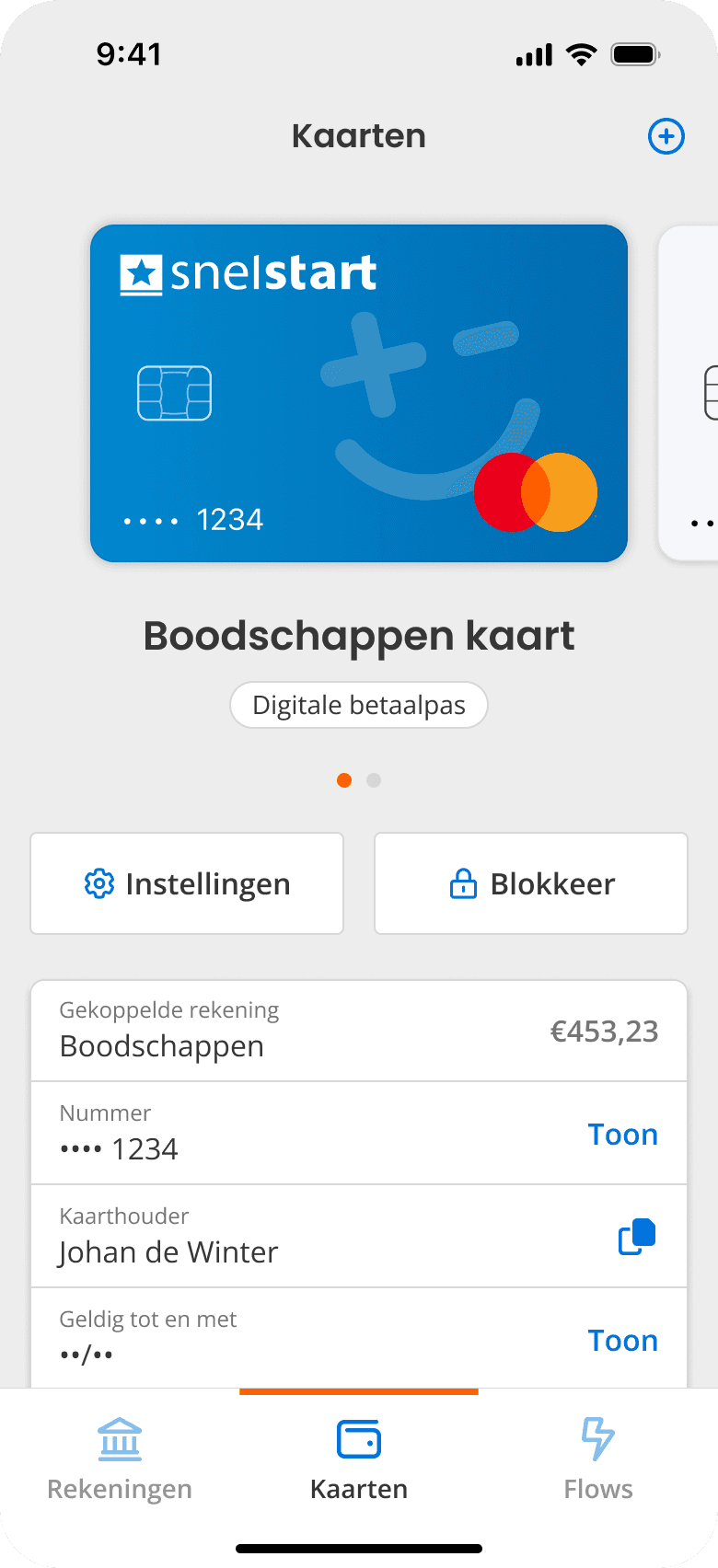

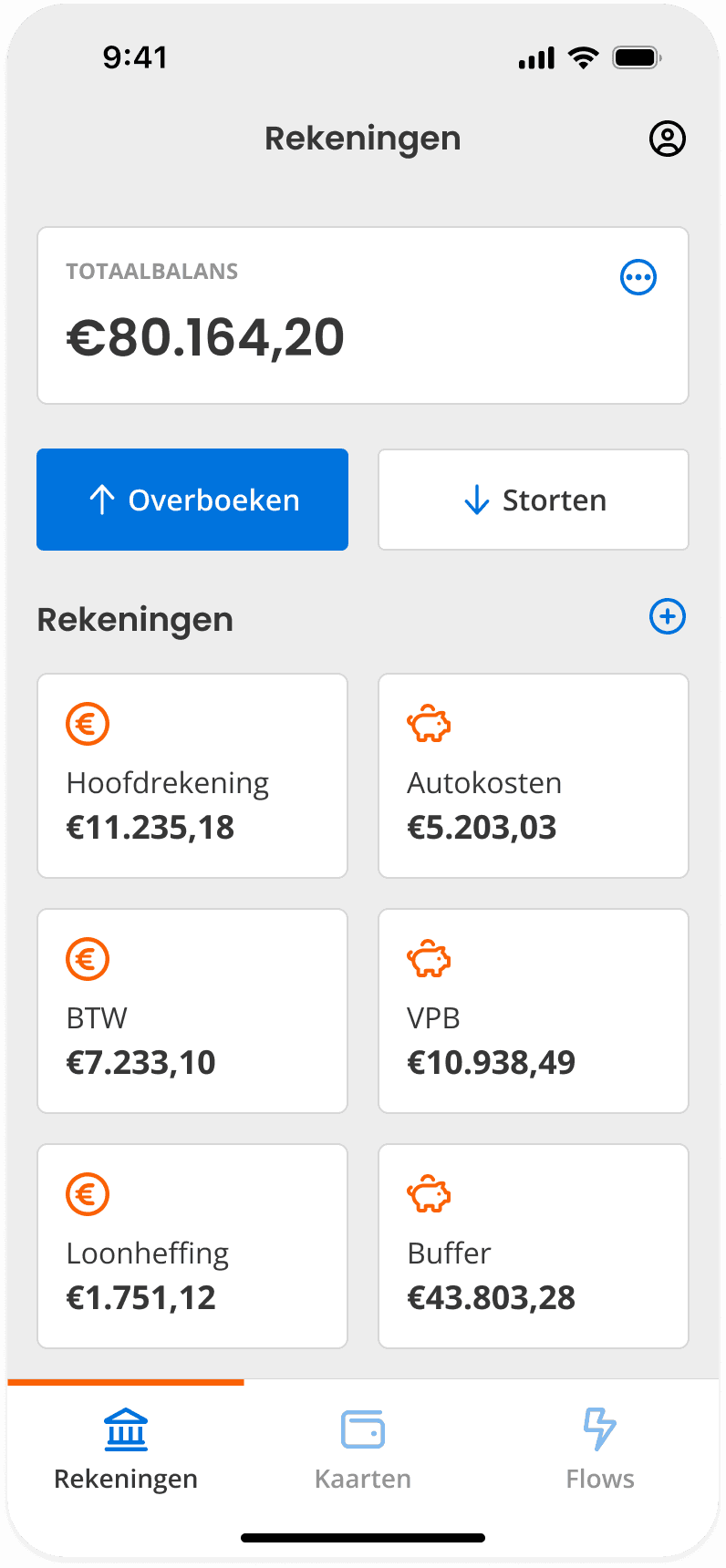

Mobile Banking from SnelStart

Manage your finances anytime, anywhere. SnelStart Bankieren brings banking and payment actions from accounting to mobile, so businesses can stay in control on the go.

Money Automation That Saves Time

When banking and bookkeeping are connected, automation becomes effortless. VAT, payroll, and business savings can be set aside automatically, reducing errors and freeing up time for what really matters—growing the business.

Key Features SnelStart Banking

Business bank accounts with real-time synchronization into accounting

Multiple IBANs for structured financial management, such as VAT and payroll separation

Interest on all accounts to optimize cash reserves

Virtual and physical debit cards for controlled business spending

Automated financial workflows that allocate funds for taxes, invoices, and savings without manual intervention

Integrated onboarding, registration and KYC

Flow for accounting software

Bringing Banking to Bookkeeping

Integrate our money management products into your accounting software and wow your customers.

The FlowOS software middle layer is the secret sauce to why our products wow your customers.

Banking integrations often disappoint. That’s precisely why we’ve developed the FlowOS software middle layer: built on top of your existing platform, it ensures our money management products work delightfully and amazes your customers.

Plus, it functions as fertile ground to build you anything our customer-centric minds can think of. Some examples are shown on the right.

Why partner with Flow?

Help your customers gain back control of their money

Improve your customers’ control over their money and help them save time and costs.

Happy customers increase retention

Together, we will amaze your customers. As their sole banking and accounting platform, clients will stay with you forever.

Become your customer's go-to financial platform

Bypass traditional banks and become your customer's single platform, taking care of all things money and accounting.

Create new revenue streams

Generate more business by introducing new products and services.

Compliance & security

Flow ticks all compliance and security boxes

We use bank grade security measures to protect your data and we’re ISO 27001 certified: a standard in information security.

PSD2 AIS

PSSD2 AIS (Account Information Service) is a provision under PSD2. It allows us to access and aggregate a user's financial data from multiple bank accounts, offering a comprehensive view of their finances.

PSD2 PIS

The PSD2 PIS (Payment Initiation Service) license is a regulatory accreditation under the EU's Payment Services Directive 2. It allows us to initiate payments on behalf of users directly from their bank accounts.

GDPR compliant

Being GDPR compliant means we fully adhere to the EU's General Data Protection Regulation by ensuring customer data is collected, processed, and stored securely, with consent, and for legitimate purposes.

Go-to-market strategy

In close cooperation, we develop value propositions that fit your customers' needs, ascertain the target audience, and decide on pricing.

Marketing & Sales

We know the benefits of our products from the inside out. That is paramount in coaching and guiding your marketing team.

Continuous support

We’re there for you all the way. That’s because we want our money management products to truly wow your customers: we wow to win.

Our partners