Flow for accounting software

Bringing Banking to Bookkeeping

Integrate our money management products into your accounting software and wow your customers.

Integrate banking services with our banking solutions

No more switching between banking and bookkeeping platforms: give your customers complete control of banking and accounting through your accounting platform. Add banking services and unlock new revenue streams.

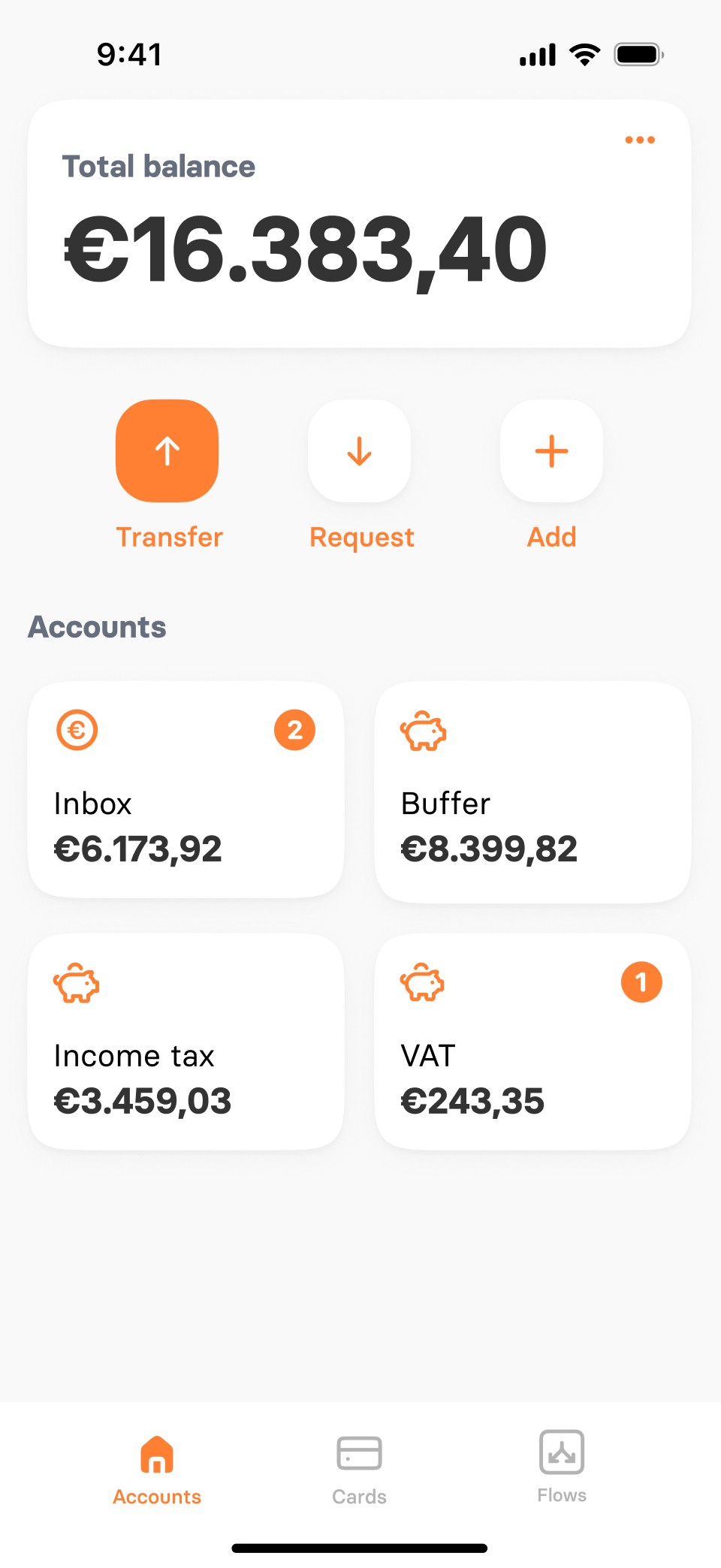

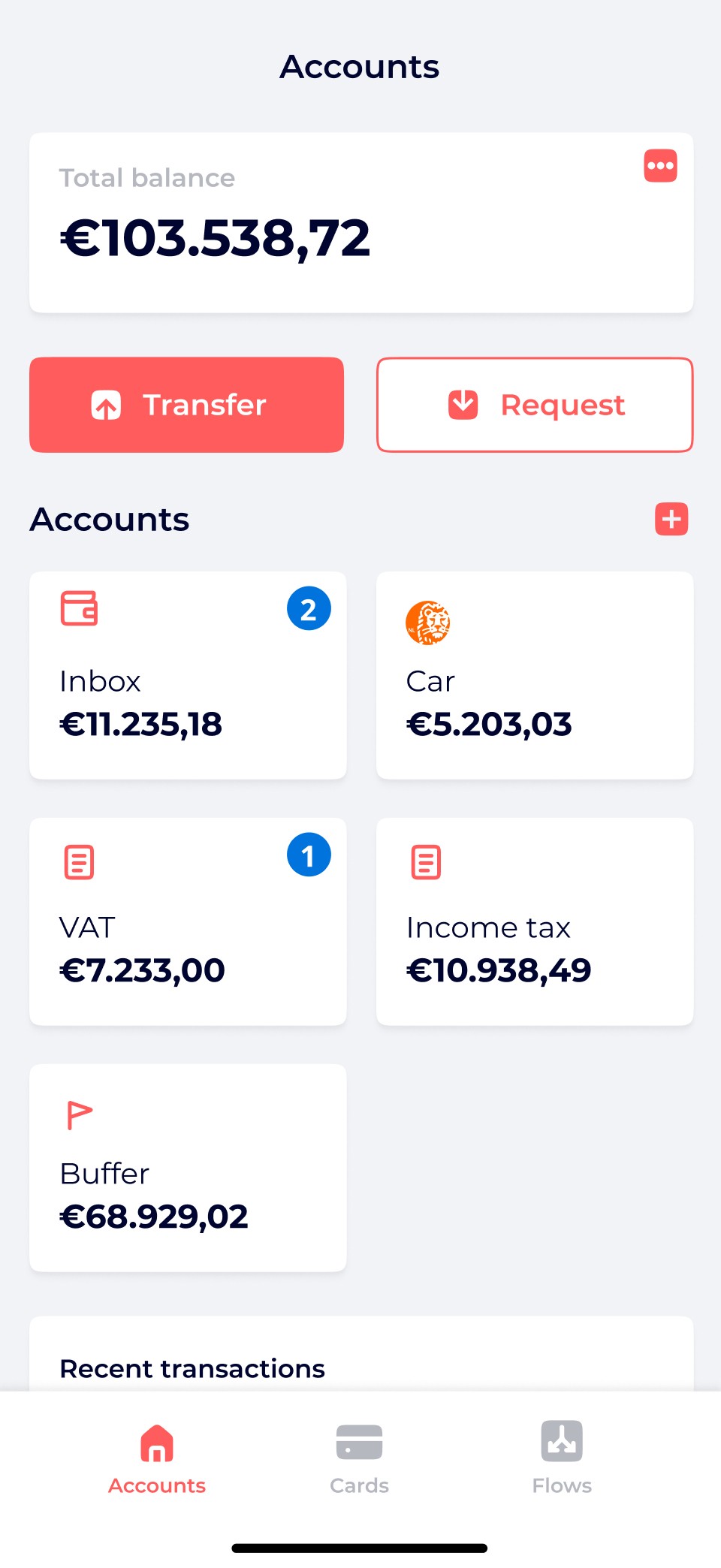

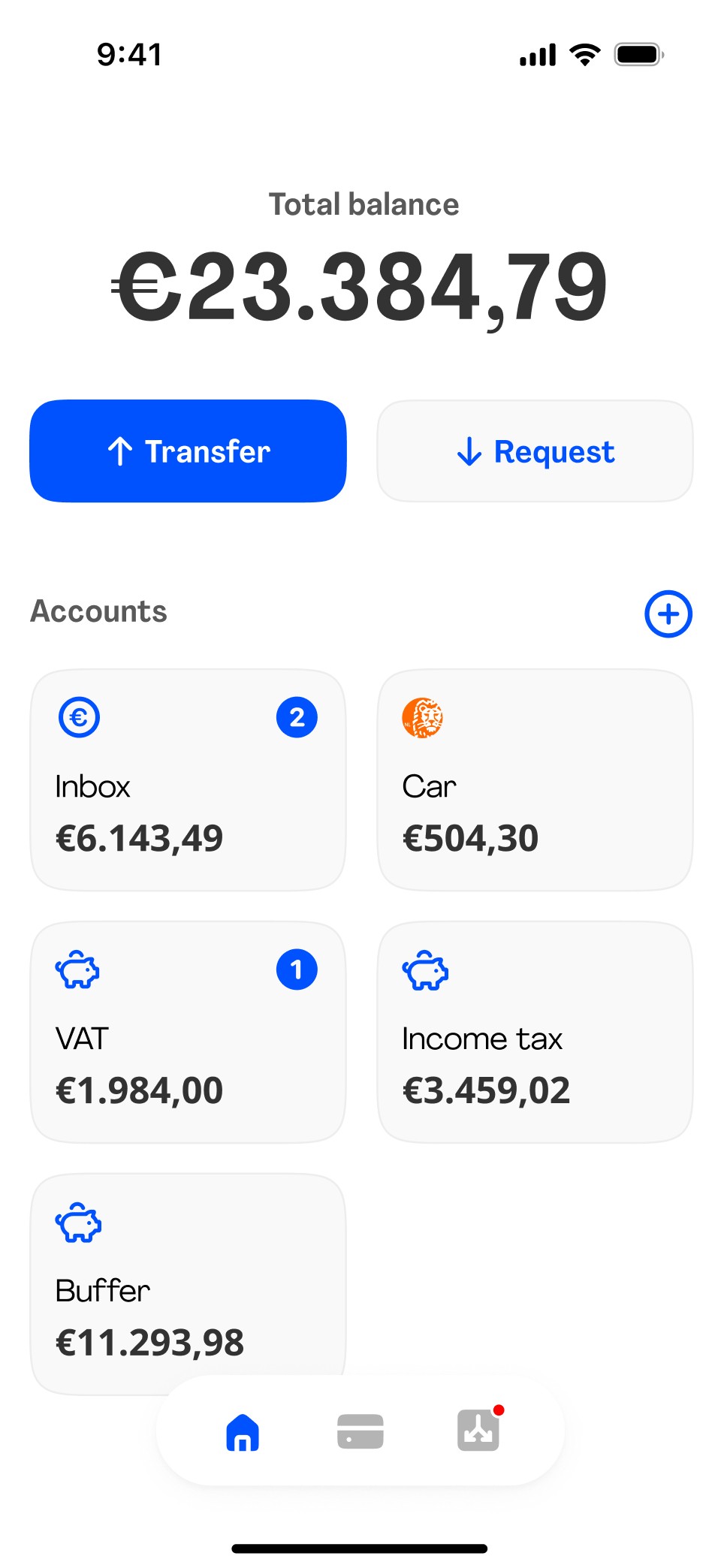

Provide your own bank accounts

Let customers create bank accounts with your bookkeeping platform to benefit from maximum automation and seamless integration of money management services.

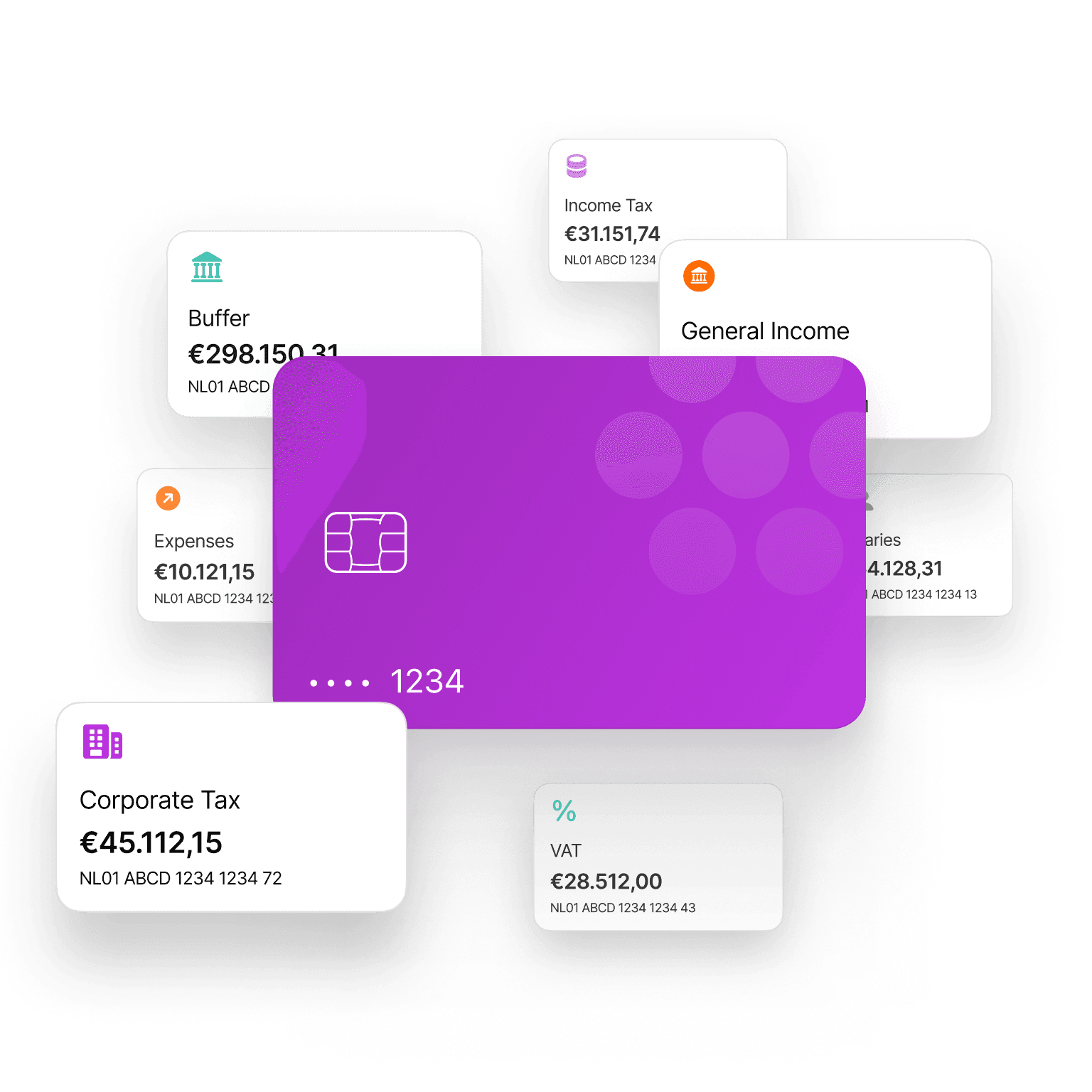

Issue branded payment cards

All payments with your branded cards are automatically processed in your bookkeeping platform. But most importantly, it’s your bookkeeping brand in their hands.

Integrate banking services the wow way

With Flow, banking services are seamlessly integrated into your accounting software, desktop or mobile. Or use the Flow white label banking app.

The Flow white label banking app.

How banking & accounting integration wows your customers

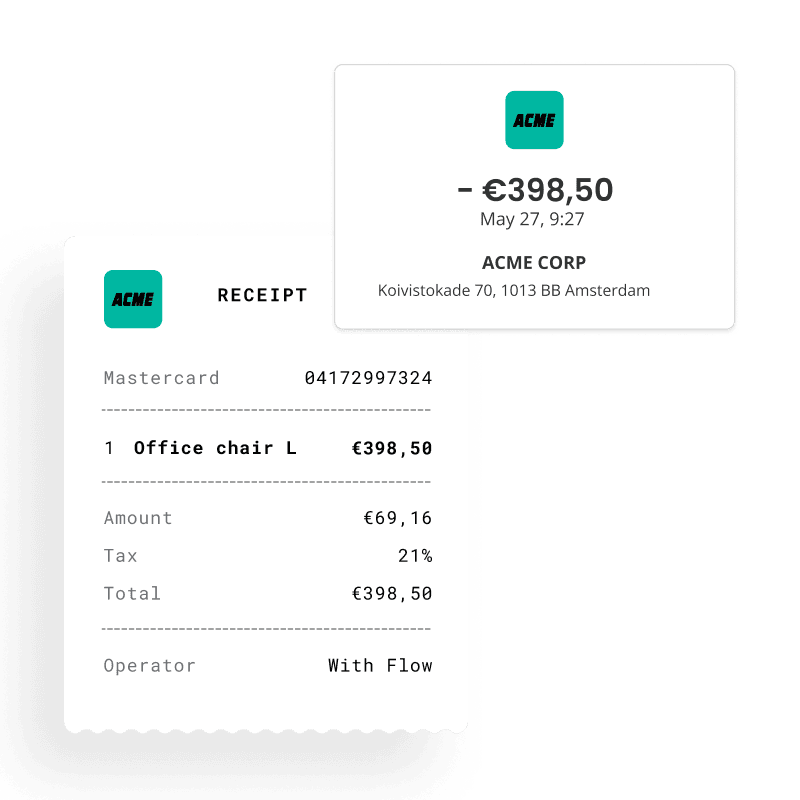

Autolink payment receipts

Card payment triggers a notification, including a nudge to upload a photo of the receipt and connect it to the relevant transaction.

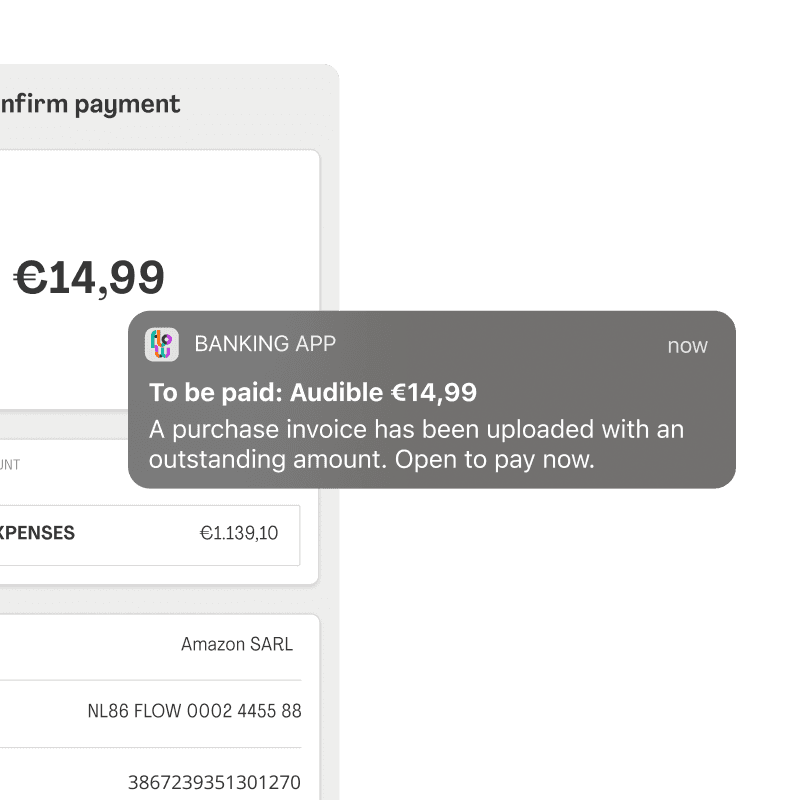

Smart payment notifications

Smart payment notifications: quickly pay taxes and invoices in time, with all data prefilled.

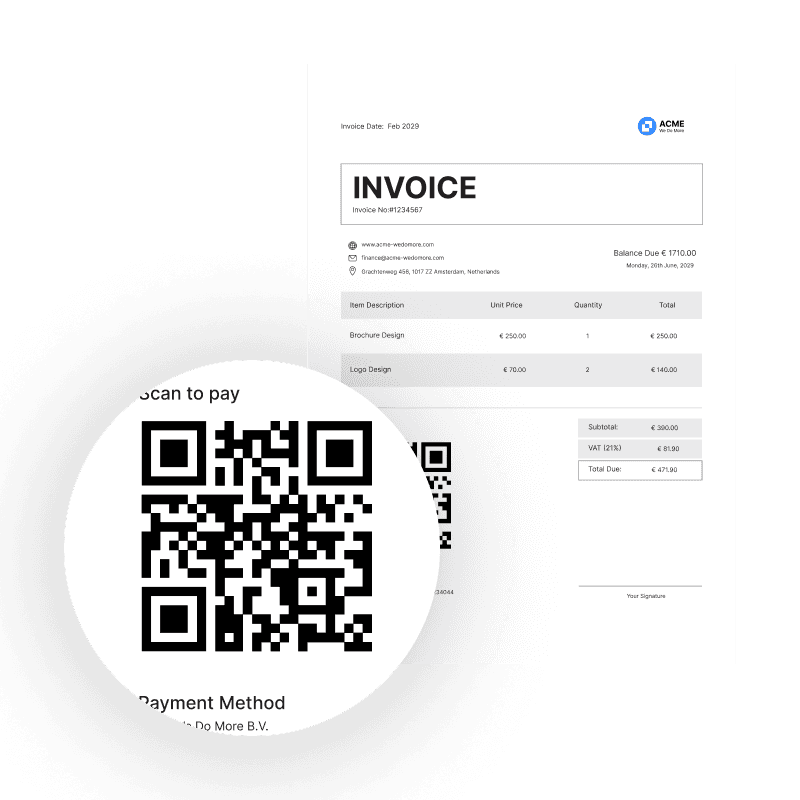

Payment links or QR-codes

Invoices with payment links or QR codes enable easy payment without copying- pasting or transcribing information.

Features we integrate

Onboarding / registration / KYC

Payment cards (physical & virtual cards / Apple or Google Pay)

Current accounts with IBANs

Payment notifications

Saving accounts, including interest

Inline payment buttons (pay purchase invoices, tax returns)

Multiple subaccounts

Approve payments with PIN or biometrics, like Face ID / Touch ID

Money transactions

Embrace the magic of money automation

Automate repetitive tasks. Assign money to different budgets and investments. It’s your customer’s money on autopilot.

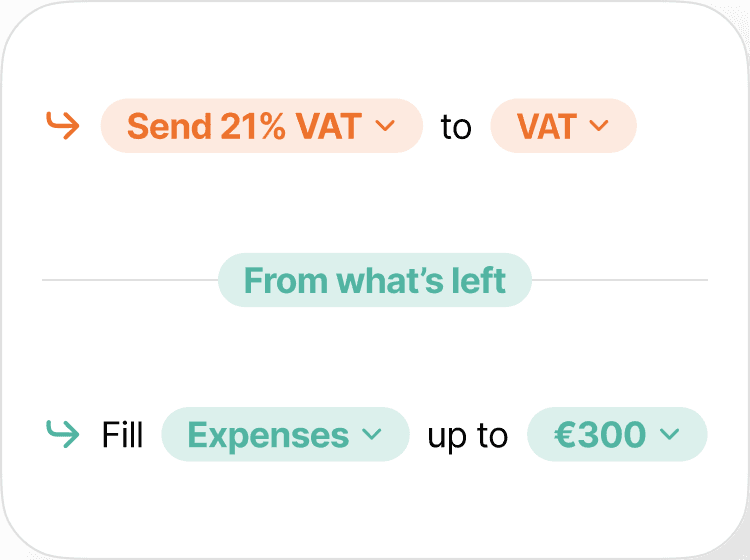

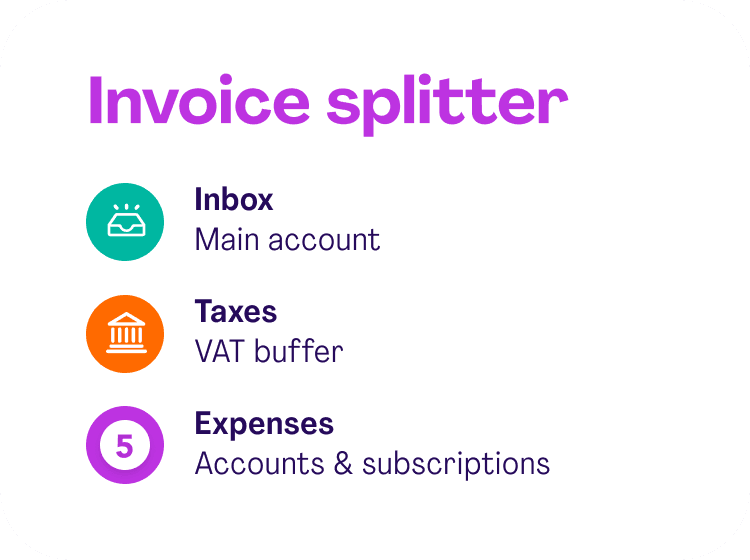

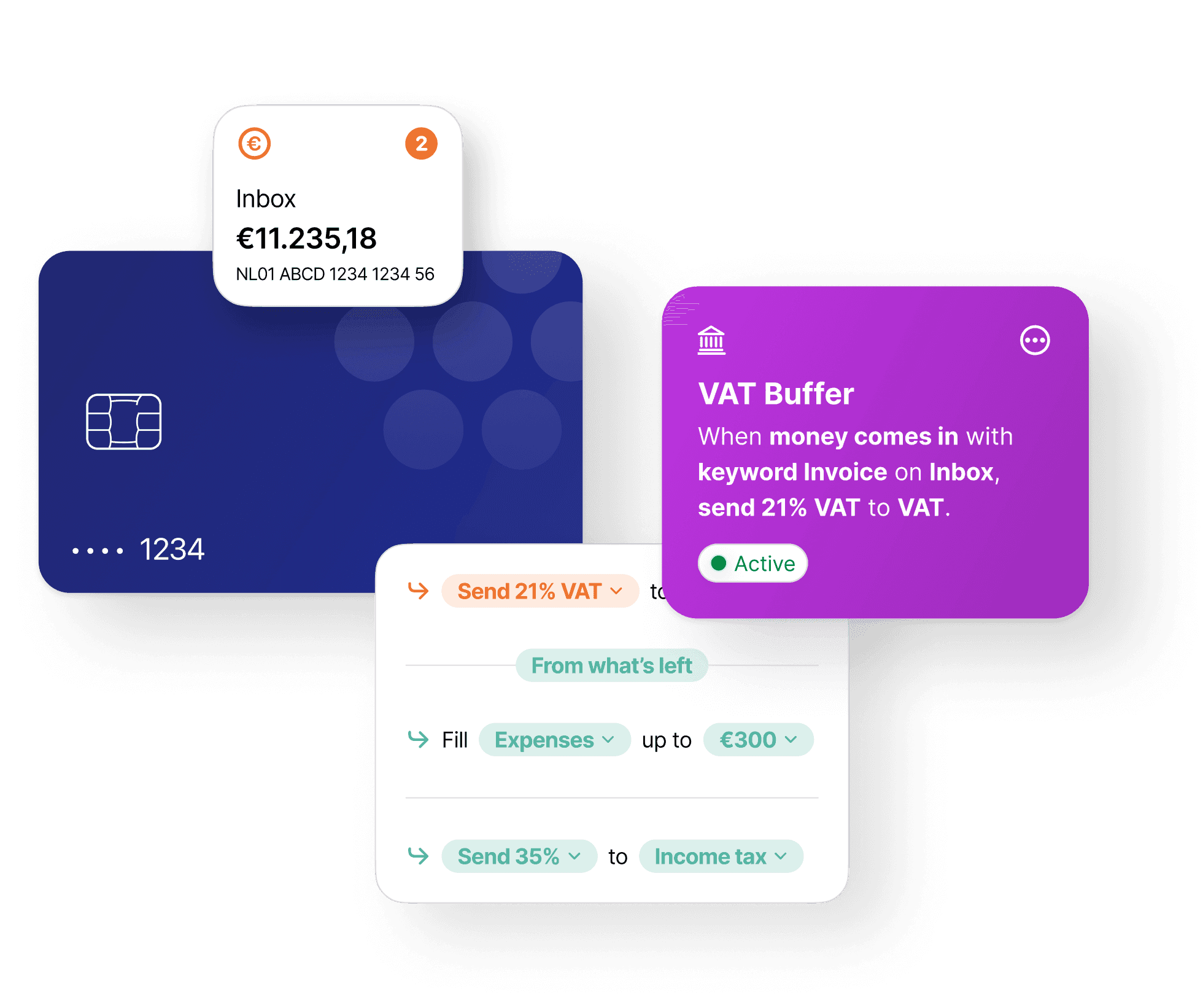

Automatically redistribute money

Redistribute incoming funds automatically to set aside VAT or corporate taxes milliseconds after the completion of the transaction.

Automated budget management

Create budgets and automatically redistribute incoming money to them to get a better grip on their business.

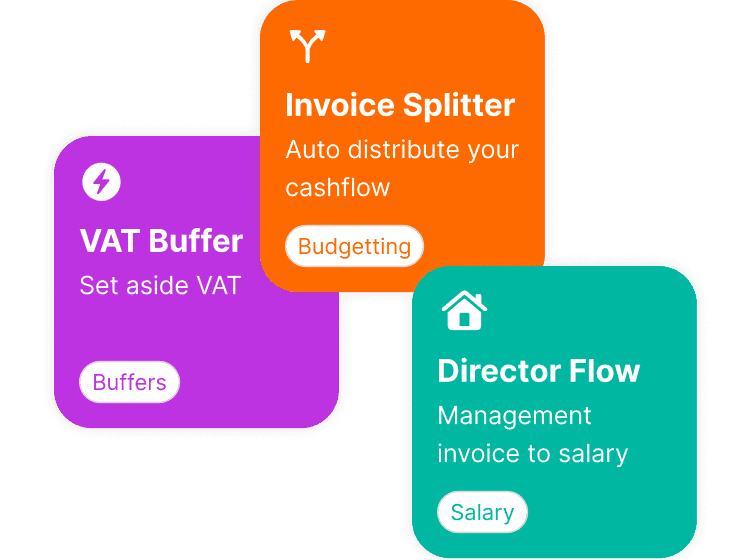

Smart money management templates

Inspire your users and help them save time with relevant and business-specific templates.

Features we integrate

Set payment actions

Design and build money automation flows

Automation templates gallery

Incoming & outgoing transaction triggers

Money transactions

Automatic payments in the background

Percentage actions

‘Fill budget to’ action

‘From what’s left’ action

‘Forward amounts higher than’ action

Connect your platform to all other banks

Let us help you to connect your platform to traditional banks. This enables your customers to apply simple money automation tasks to and from their other existing bank accounts. It’s Open Banking as good as it gets.

Let customers use their existing bank accounts in your platform

Enable customers to transfer funds, view up-to-date balances, and pay invoices and taxes using their existing bank accounts.

Use existing traditional bank accounts as a bridge

Customers can use their existing bank account as a source to redistribute money within your platform.

Become your customers’ go to financial platform

Facilitate a smooth shift for your customers from their existing bank to your banking services.

Features we integrate

Connect all bank accounts

Access to up to date balances

Access to all transaction data

Automated payment notifications

Initiate payments

Inline payment buttons (pay purchase invoices, tax returns)

Enable money automation between banks

The FlowOS software middle layer is the secret sauce to why our products wow your customers.

Banking integrations often disappoint. That’s precisely why we’ve developed the FlowOS software middle layer: built on top of your existing platform, it ensures our money management products work delightfully and amazes your customers.

Plus, it functions as fertile ground to build you anything our customer-centric minds can think of. Some examples are shown on the right.

Why partner with Flow?

Help your customers gain back control of their money

Improve your customers’ control over their money and help them save time and costs.

Happy customers increase retention

Together, we will amaze your customers. As their sole banking and accounting platform, clients will stay with you forever.

Become your customer's go-to financial platform

Bypass traditional banks and become your customer's single platform, taking care of all things money and accounting.

Create new revenue streams

Generate more business by introducing new products and services.

Compliance & security

Flow ticks all compliance and security boxes

We use bank grade security measures to protect your data and we’re ISO 27001 certified: a standard in information security.

PSD2 AIS

PSSD2 AIS (Account Information Service) is a provision under PSD2. It allows us to access and aggregate a user's financial data from multiple bank accounts, offering a comprehensive view of their finances.

PSD2 PIS

The PSD2 PIS (Payment Initiation Service) license is a regulatory accreditation under the EU's Payment Services Directive 2. It allows us to initiate payments on behalf of users directly from their bank accounts.

GDPR compliant

Being GDPR compliant means we fully adhere to the EU's General Data Protection Regulation by ensuring customer data is collected, processed, and stored securely, with consent, and for legitimate purposes.

Go-to-market strategy

In close cooperation, we develop value propositions that fit your customers' needs, ascertain the target audience, and decide on pricing.

Marketing & Sales

We know the benefits of our products from the inside out. That is paramount in coaching and guiding your marketing team.

Continuous support

We’re there for you all the way. That’s because we want our money management products to truly wow your customers: we wow to win.

Our partners